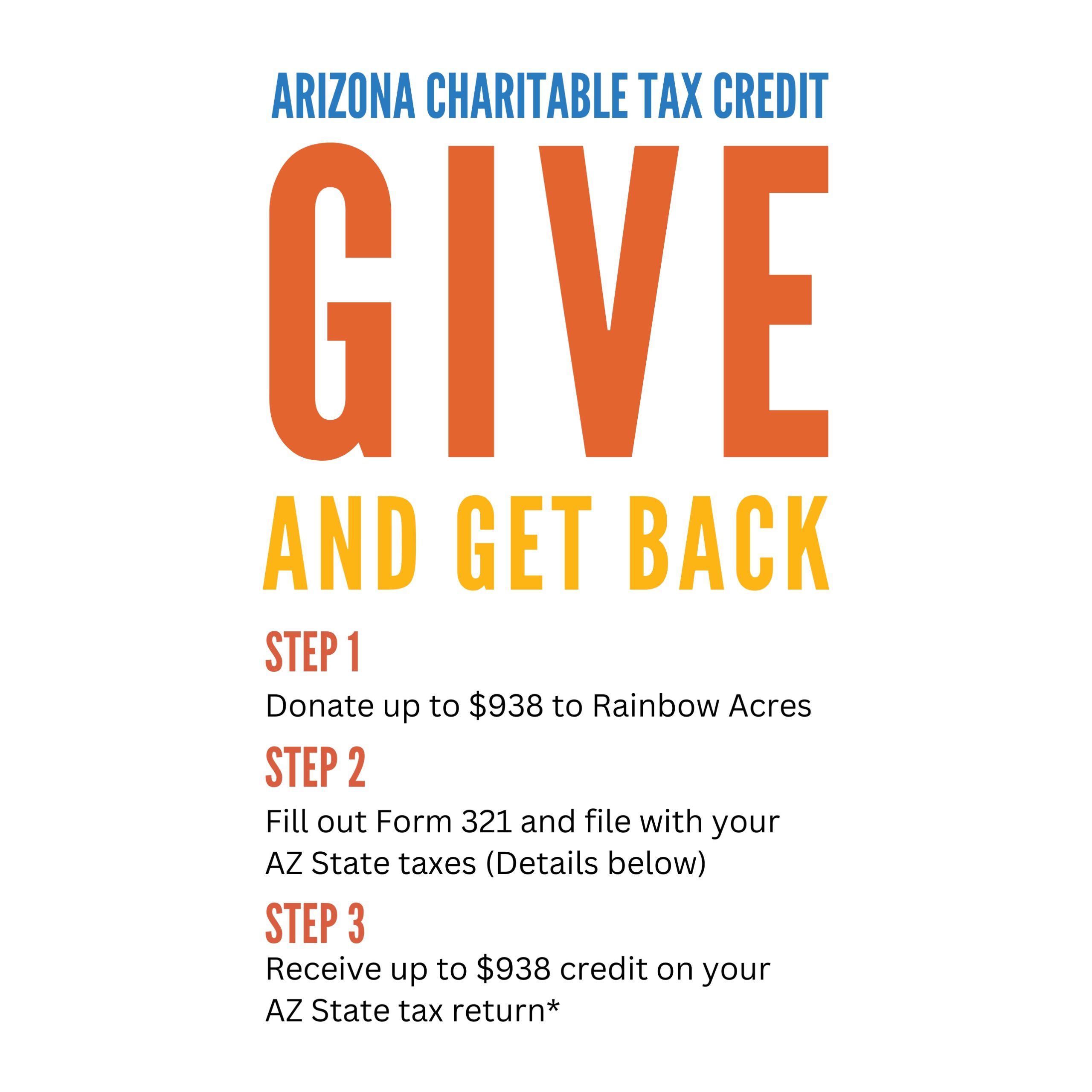

Arizona Charitable Tax Credit

Arizona residents can receive a dollar-for-dollar tax credit when giving to Rainbow Acres! In 2024, donate up to $470 for individuals or $938 for those filing jointly if you have a tax liability to the State of Arizona. Donate, and the State of Arizona will give the money back in your tax return.*

Use Rainbow Acres Arizona Qualified Charitable Organization (QCO) #20399 on the Arizona Tax Form 321 when filing your 2024 taxes. Since Rainbow Acres is a 501(c)(3) not-for-profit organization, your contribution could also be deductible from your federal taxes.*

Your gift goes directly to sustain the mission and operations of Rainbow Acres.

The maximum QCO credit donation amount for 2024:

$470 single, married, filing separate, or head of household

$938 married filing joint

The maximum QCO credit donation amount for 2025:

$495 single, married filing separate or head of household

$987 married filing joint

Please Note: Arizona law allows QCO donations made during 2024 or donations made from January 1, 2025, through April 15, 2025, to be claimed on the 2024 Arizona income tax return. The maximum credit that can be claimed on the 2024 Arizona return for donations made to QCOs is $470 for single, married filing separate or head of household taxpayers and $938 for married filing joint taxpayers. If a taxpayer makes a QCO donation from January 1, 2025, through April 15, 2025, and wants to claim the higher 2024 maximum credit amount, the taxpayer will need to claim the credit on the 2025 Arizona return filed in 2026. The tax credit is claimed on AZ Form 321.

Please visit the Arizona Department of Revenue website for complete information.

*Rainbow Acres is not a tax advisor. Contact a qualified professional for expert advice on your tax situation.

We appreciate your support!